GST on Fertilizers, Agrochemicals & Seeds (2025) - New Rates & Savings for Farmers

From September 2025 the GST Council of India has reduced tax rates on many important farm products. Farmers will now pay much lower GST on fertilizers, pesticides and seeds. This article clearly explains the new GST rates on different fertilizers (like urea, DAP, NPK, organic), agro-chemicals (like insecticides, herbicides, and bio-pesticides) and seeds along with a comparison of old and new GST rates.

Quick View: New GST Benefits for Farmers (2025 Update)

- Fertilizer GST cut to 2.5% – Urea, DAP, NPK, and Potash now cheaper than before.

- Bio-fertilizers & organic manure: 0–2.5% GST – Encouraging natural farming.

- Pesticides GST reduced to 9%, bio-pesticides only 2.5% – lower pest control cost.

- Seeds for sowing: 0% GST – farmers continue to buy seeds tax-free.

- Farm machinery & irrigation tools: 5% GST – cheaper for new equipment.

- Overall cost of cultivation reduced, helping every small and large farmer in India.

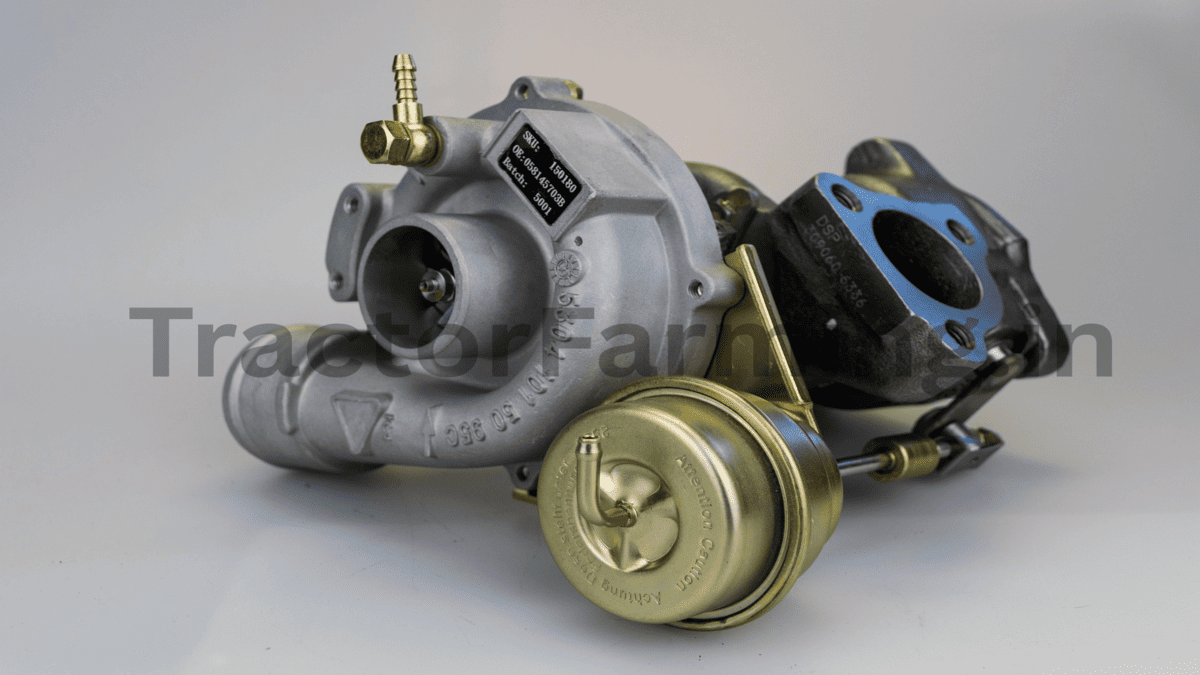

Also read: GST on Tractor, Equipment & Tyres

GST Rates for Fertilizers in 2025

1. Key chemical fertilizers (Urea, DAP, NPK, Potash): 2.5% GST

The main fertilizers that farmers use such as Urea, Di-Ammonium Phosphate (DAP), NPK mixtures, and Muriate of Potash (MOP) are now taxed at only 2.5% GST. Earlier these fertilizers had 5% GST after 2017. This means that the tax rate has been reduced by half, so fertilizer prices are expected to come down in shops and cooperatives.

2. Fertilizer raw materials: 2.5% GST

Many raw materials used in making fertilizers such as sulphuric acid, nitric acid and ammonia earlier had 18% GST. Now they are taxed at 2.5% GST. This is a big change because earlier raw materials were taxed higher than the finished product. This was called the “inverted duty” problem — when input cost was taxed higher than the final product. By cutting GST on these raw materials the government has made it easier and cheaper for fertilizer companies to produce fertilizers. This helps bring down prices for farmers.

3. Organic fertilizers and manure: 0 - 2.5% GST

Organic manure and compost if sold in bulk and not in branded packets are fully exempt from GST 0%. If organic fertilizers are sold in small branded packets they carry 2.5% GST. This keeps organic and natural farming affordable for small and medium farmers.

4. Bio-fertilizers: 0 - 5% GST

Bio-fertilizers (like Rhizobium, Azotobacter, Phosphate Solubilizing Bacteria, etc.) are mostly treated as organic products. They generally fall under the 0–5% GST range depending on packaging and classification. This makes natural soil-improving products cheaper and encourages eco-friendly farming.

GST on Agro-chemicals (Pesticides, Insecticides, Herbicides)

1. Chemical pesticides, insecticides and herbicides: 9% GST

Most chemical-based pesticides, insecticides, fungicides and weed killers now come under 9% GST. Earlier the tax was 18%. For example a pesticide bottle that earlier had ₹18 tax on ₹100 value will now have only ₹9 tax. This means a direct reduction in price for farmers buying pest and herb control products.

2. Bio-pesticides: 2.5% GST

The GST on 12 major bio-pesticides (such as Bacillus thuringiensis, Trichoderma and neem-based bio-pesticides) has been cut from 12–18% down to 2.5%. Bio-pesticides are natural pest control agents that are safer for soil and humans. This tax cut makes them more affordable and encourages their use in organic and sustainable farming.

3. Micronutrients and bio-stimulants: 2.5% GST

Special plant growth materials like zinc, boron, neem oil, gibberellic acid and other micro-nutrients under the Fertilizer Control Order are now taxed at 2.5% GST. Before this change they had 12% GST. This reduction helps farmers who use micronutrients to improve crop quality and yield. Examples:

- Chemical insecticides – 9%

- Herbicides – 9%

- Bio-pesticides – 2.5%

- Micronutrients and growth promoters – 2.5%

GST on Seeds and Related Inputs

1. Sowing seeds: 0% GST (Exempt)

All seeds used for planting such as those for wheat, paddy, maize, vegetables, fruits, flowers and even spices are completely GST-free. Farmers do not have to pay any GST when buying certified seeds for sowing.

2. Oilseeds and edible seeds: 2.5% GST

Seeds that are not used for sowing such as mustard seeds for oil or sesame for oil extraction now attract 2.5% GST. Only seeds for planting are fully exempt.

3. Fish and shrimp seeds: 0% GST

Seeds used in fish farming and aquaculture such as fish fingerlings and shrimp seeds are also free from GST. This helps fish farmers save on input costs.

4. Seed drills and sowing equipment: 5% GST

Equipment used for sowing and planting like seed drills, planters and fertilizer applicators are taxed at 5% GST. This is part of the agricultural machinery benefits.

Exemptions and Concessions

1. Seeds and organic inputs

As explained above seeds for sowing and organic manures are fully exempt from GST (0%). This means farmers can buy them without paying extra tax.

2. Patents and biotechnology

New biotechnology-based farming inputs such as bio-enzymes or genetically improved microbes often fall in the lower GST slabs or exemptions. This helps companies innovate and farmers access modern, eco-friendly solutions.

3. Other concessions

The government has also reduced GST on farm machinery and irrigation items. For example tractors, tillers, diesel engines (up to 15 HP) and drip irrigation systems are taxed at 5% GST. These changes reduce costs for farmers who buy new machinery or irrigation tools.

Also read: GST on Tractor, Equipment & Tyres

Comparison Table: GST Rates 2025 vs Post-2017

| Product | GST-2025(%) | Old GST(%) |

| Urea (nitrogenous fertiliser) | 2.5 | 5 |

| DAP (phosphatic fertiliser) | 2.5 | 5 |

| Muriate of Potash (potassic) | 2.5 | 5 |

| Fertiliser-grade Sulphuric/Nitric/Ammonia | 2.5 | 18 |

| Bio-pesticides | 2.5 | 12 - 18 |

| Chemical pesticides/insecticides | 9 | 18 |

| Micronutrient mixtures | 2.5 | 18 |

| Seeds (for sowing) | 0 | 0 |

| Other edible/spice seeds | 2.5 | 0 |

| Organic manure (bulk) | 0 | 0 |

| Fertilisers (NPK, mixed) | 2.5 | 5 |

GST 2017 rates refer to initial post-GST rates. ‘Agriculture inputs exempt’ includes many fresh produce items, but here we focus on fertilizers, seeds, and agrochemicals.

How These Changes Help Farmers?

These new GST rates are a major relief for the farming community. Lower GST means:

- Lower prices of fertilizers, seeds and pesticides.

- Reduced crop production cost for farmers.

- Encouragement for organic and bio-based farming.

- Simpler billing and compliance for agro-dealers.

For example a 50-kg bag of urea that earlier included ₹15 GST may now include only about ₹7.5 GST. This difference can add up to big savings across a season. Farmers should check their purchase bills to ensure that the new GST rates are correctly applied by the dealers.